Creating a Retirement Plan

The Problem

For most people, the phrases: retirement plan and 401(k) are interchangeable. But this is a problem.

Why?

Because despite popular terminology, 401(k)s, 403(b)s, and IRAs aren't actually "plans", they are simply vehicles to help you achieve your plan.

In any other context, when you talk about a "plan" there's at least some some level of specifics -- specific action items, or a timeline perhaps... Why should planning the largest financial transition of your life be any different?

Imagine boarding a plane after hearing the pilot say: "Looks like our instrumentation is on the fritz, but I know our destination is a couple hundred miles northeast. As long as we get over the mountains we should be okay."

Part of the reason that conversation feels so bizarre is because this would never happen. Commercial flights are planned months in advance, closely monitored from takeoff to landing, and are continuously analyzing live data on weather, altitude, and more.

In short, flights are well-planned and capable of making snap changes based on factors beyond the airline's control.

How to Create a Retirement Plan

A true retirement plan is knowing when you will retire, how much you will have saved up, and what your budget is going to be. There are a number of factors that play into the plan such as inflation, economic conditions, salary changes, unexpected financial events, and more.

If you don't already have a solid retirement plan, then now is the time to get one! It can be difficult to think about retirement (especially if it's far away), but it is absolutely crucial.

If you want to get started with a retirement plan but don't know where to start, we've got you covered with a simple four step process outlined below.

1. Set a Date

By creating a retirement plan far enough away from retirement, you can have the luxury of setting a target date. One helpful tip: it may be easier to choose a retirement age first, then determine the year.

It's important to note that there is no "one-size-fits-all" answer to when you should retire because each person is different and has unique needs and timetables.

That said,

as of 2021, on average, Americans began their retirement at age 62¹.

2. Set a Retirement Budget

This can be a daunting task, but consider starting with the basic monthly expense categories of:

- Home

- Food

- Transportation

- Medical

- Entertainment (inc. travel).

While there are other costs that may not have fallen in those categories, it's still a good starting point. Which brings us to the next step...

💡 Pro Tip 1: Don't forget to account for cost of living! If you plan to retire in an area with similar cost of living to where you are right now, this may not be as much of a factor.

💡 Pro Tip 2: Calculate monthly expenses in today's dollars rather than accounting for inflation at this point.

💡 Pro Tip 3: If you get stuck on a category and don't know how much to budget, try looking up what "average ___ spending in retirement ___" where the first blank is the category and the second is the state/area you want to live.

3. Total Required Savings

With your rough idea of monthly costs in retirement, it's time to calculate how much you need saved up to fund that lifestyle.

People often calculate this as the product of their expected monthly costs and number of months spent in retirement as shown below.

( Monthly costs x Number of months in retirement )

However, doing it this way will likely result in you having more money saved than necessary. Because the lump sum you are chipping away at to fund your retirement is probably not sitting in a savings account. Chances are, it's in a retirement account earning interest.

In order to properly account for factors like inflation and investment ROI, you will need to think of this as periodic withdrawals from a lump sum. There are a number of online resources for those equations, if you want to do them yourself.

💡 Pro Tip: If you want access to a tool that can walk you through this process and crunch the numbers for you, check out StockMotion on the App & Play Stores. Premium members have access to an entire curriculum about retirement planning!

4. Save, Save, Save!

Now that you know how much money you will need to retire, you will want to determine how much to contribute each month to your retirement account in order to accumulate that sum by retirement.

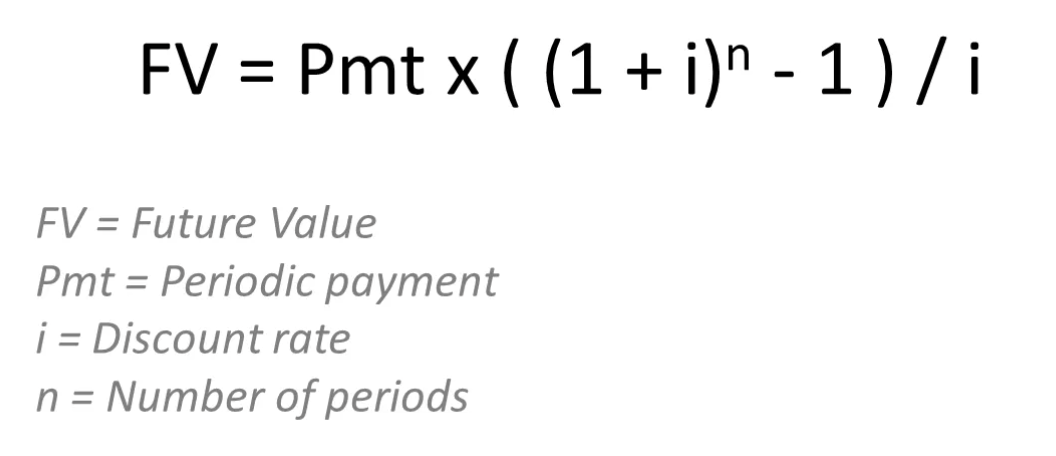

Because you know the future value of your retirement account (don't forget to adjust for inflation), you can calculate the needed monthly payments using the simple time value of money formula² shown below.

💡 Pro Tip: StockMotion can help you develop your own retirement plan and has built-in tools to do this kind of math for you!

In Conclusion...

The old-fashioned retirement "plan" is the act of directionless saving and often results in delayed or stressful retirements. That's because it's not truly a plan.

A retirement plan can be highly complicated to put together, but just like a flight plan, is not something you want to skip out on, especially considering the tremendous effects it will have on what should be one of the best times of your life.

Unfortunately, where only 52% of working adults think they will have enough money to retire in comfort³, it has never been more important to get your financial house in order, including creating and sticking to a detailed retirement plan.

StockMotion makes the entire process of creating a retirement plan quick and easy. If you haven't already, check it out!

Sources:

1: Mean age of retirement: https://news.gallup.com/poll/350048/retirees-experience-differs-nonretirees-outlook.aspx

2: PMT formula from annuity due: https://www.double-entry-bookkeeping.com/future-value/annuity-due/

3: 52% think they will be able to afford to retire: https://news.gallup.com/poll/350048/retirees-experience-differs-nonretirees-outlook.aspx