How to Locate a Company's Financial Data

May 18, 2021

Let's Back Up For A Second...

First of all, if you haven't heard of the Securities and Exchange Commission (SEC) yet, you'll probably want to become familiar... It is an independant part of the United States Government and is responsible for regulating investing activities to ensure a free and fair market. It was established in 1934 in response to the events leading up to the great stock market crash of 1929 which resulted in the Great Depression, which you have likely heard of before.

Among many others, some of its responsibilities include; prevention of fraud and market manipulation, governance and enforcement of laws regarding securities (investments) and the exchanging of securities, as well as advocating for general investor education (just like we at StockMotion do!) If you're interested in learning more about the SEC,

visit their site here

What SEC Edgar?

No, Edgar isn't some guy that works over at the SEC (apologies to anyone actually named Edgar and works over at the SEC). Edgar actually stands for Electronic Data Gathering, Analysis and Retrieval. Okay, that probably isn't the most exciting abbreviation you've ever heard of, but it's actually a really cool system!

Edgar is basically a massive database chalk full of companies' yearly and quarterly earnings reports and all sort of other awesome data. What does that actually mean for you though? It means that if you want to know how much revenue Tesla Inc. brought in during 2020, you

can do just that. Pretty cool right?

Figure 1.1: Search for a company or ticker symbol in SEC Edgar

How To Find Companies' Financial Data

When you open up the

Edgar Company Search Page, you will find a search bar that looks something like the above Figure 1.1. Once you've located the search bar, you can enter in either a ticker symbol or company name (e.g. GameStop Corp. or GME would work when searching for data on Gamestop)

Once you've selected the company you are looking for from the dropdown menu, you'll be taken to a page that looks something like Figure 1.2 below. From here, we have many options, but we'll just focus on one today; finding information in an annual or quarterly report.

Figure 1.2: Find data in a company's annual or quarterly earnings reports

Selecting and Interpreting a Report

Notice the section on the page called "Selected Filings". (If on a mobile device, you may need to scroll down a little to find it). From the list, you'll see a tab called "10-K (annual reports) and 10-Q (quarterly reports)". If you click on this tab, it will expand into a bulleted list of 10-Ks and 10-Qs with the most recent reports appearing at the top of the list. If the report you are looking for is older than those listed, you can simply click the "View all 10-Ks and 10-Qs" button.

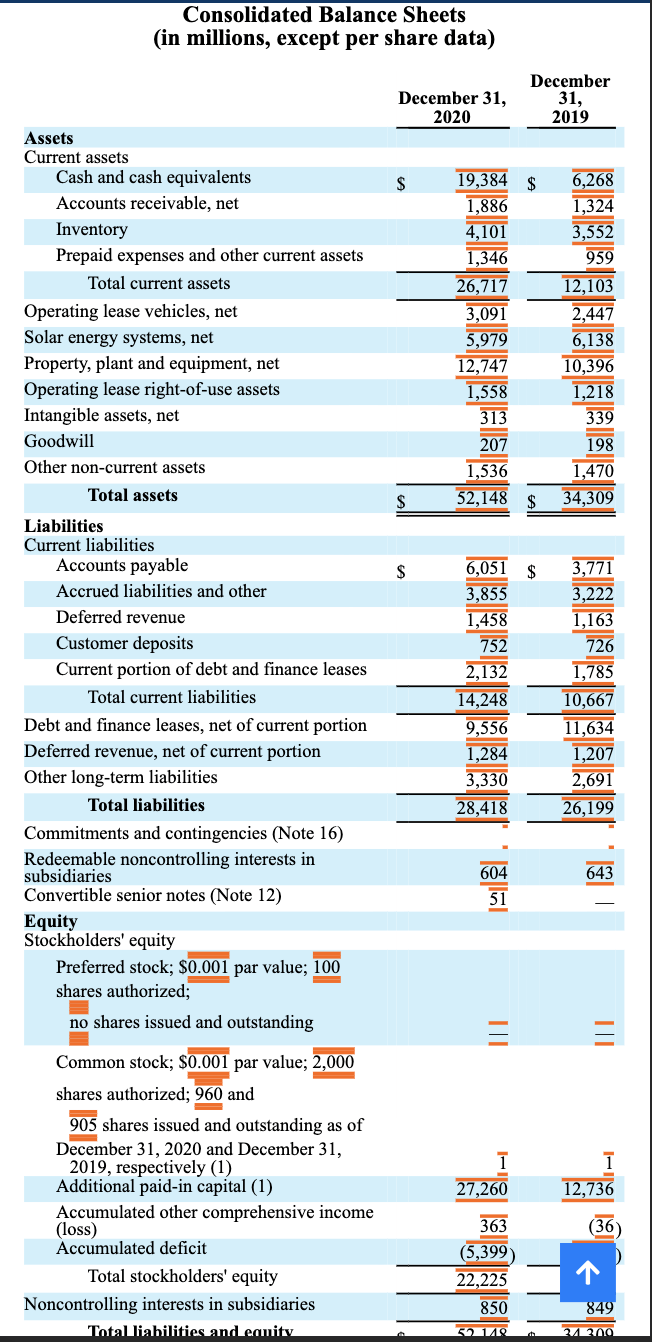

Once you've opened your report, you'll soon scroll to a table of contents. From here, you'll want to look for an option that will say something along the lines of "Financial Statements" (usually Item 8 in the table of contents). Tap that link and you will likely be taken to another, smaller table of contents. This time, you should look for an option called "Consolidated Balance Sheets". Once you click that link, you will find a table of financial data for that reporting period! And now, you're able to do in depth research on any publicly listed company!

StockMotion is an app that teaches financial literacy and is available for free on both the App and Play Stores. In this article, we highlight the investing basics curriculum that walks players through the fundamental concepts of investing and serves as a great starting point for your investing journey!

Depending on your age, retirement may seem a long way off in the distance, but failing to have a specific goal and plans to reach it will likely cause your retirement to be stressful or delayed altogether. In this post, we'll take a look at what a retirement plan is and how you can get started on your own plan!

We know that talking about investing and the stock market can sometime sound like an alien language. The term, P/E ratio, is not any different sounding like jargon but it's actually a simple concept once we break it down. First off, let's talk about the P/E, it stands for Price-to-Earnings. More specifically, price refers to the stock price of the share and earning refers to, well, the total earnings of the company divided by the outstanding shares. Note: outstanding shares means the total number of shares issued by the company which include shares kept within the companies and owed by the shareholders, us. So for example, the company Good Food store has a stock price of $1. Over the past month, Good Food store earned $100 and it has 200 outstanding shares. So P or Price which is just stock price = $1. So for E or Earning, we take the $100 earned and divide it by the 200 shares, equalling .5. To finish calculating the ratio we have to divide P/E or $1/.5 which turns out to be 2. So we are left with a P/E ratio of 2. Now what? Well, it depends.

401(k). It’s one of the most common ways to save for retirement, but how do you know which kind to invest in? This is a frequently asked question, especially among young people just starting out their careers in companies that offer retirement benefits. To start off, let’s talk about what a 401(k) actually is. Luckily, 401(k) is not referring to a long-distance race (I think far fewer people would be interested in it if it were). It’s just a retirement savings/investment tool that was named after a section of the U.S. Internal Revenue Code. Typically, if you invest in a 401(k) through your employer, your money will be managed by an advisor, often from some sort of investment management company like Fidelity. That’s not to say that you don’t have any say in how your money is invested--you certainly have input over your own money. Many companies allow employees to contribute part of their paycheck to a 401(k). Some companies even offer to match their employees’ contributions, up to a certain percentage. As of 2021, the max amount that can be contributed to a 401(k) in a given year is $19,500 for employees under 50-years-old and $26,000 for employees who are 50 years of age or older. That extra $6,500 for employees over 50 is called a catch-up contribution. It allows said employees to more easily meet their retirement goals as they draw closer to it. So, when that percentage of your paycheck gets taken out, where exactly is it going? The money that is invested in a 401(k) will generally include an array of stock and bond mutual funds, as well as target-date funds. The specific makeup will depend on a few factors, one of the most important ones being how close you are to retirement (the closer you are, the lower the risk because you won’t be playing the long game in the stock market anymore). With all of this information about 401(k)’s, how do I know which kind to invest in? That decision is going to depend on personal preferences, but what you need to know about the differences between a Roth and a Traditional 401(k) comes down to how they are taxed. Contributions to a Roth 401(k) are taken from after-tax dollars. That means you are investing money from your paycheck that has already been taxed and don’t have to worry about paying taxes on it (or its growth) when you withdraw money from it in retirement. One thing to note is that your employer match portion in a Roth 401(k) will be subject to taxes when withdrawn. Contributions to a Traditional 401(k) are taken from your paycheck’s pre-tax dollars. That means that your taxes will be lower now, but you will pay taxes on everything you withdraw in retirement. When they are withdrawn, they will be taxed at an ordinary income tax rate, with most state income taxes applying as well. So, which type of 401(k) to invest in comes down to you. Do you think income taxes will be higher today or during retirement? Do you think you will be making more money now or later? Now that you have an understanding of the differences between the two, these are just some questions to consider when deciding on a Roth vs Traditional 401(k). Citations: Dave Ramsey, “401(k) vs. Roth 401(k): Which One Is Better?,” Ramsey Solutions (blog), June 17, 2021, accessed 8/3/2021, https://www.ramseysolutions.com/retirement/traditional-401k-vs-roth-401k . Jason Fernando, “401(k) Plans: The Complete Guide,” Investopedia, March 11, 2021, accessed 8/3/2021, https://www.investopedia.com/terms/1/401kplan.asp . Kristin McKenna, “Should I Pay Someone to Manage My 401(k)?,” Forbes, February 22, 2021, accessed 8/3/2021, https://www.forbes.com/sites/kristinmckenna/2021/02/22/should-i-pay-someone-to-manage-my- 401k/?sh=b6dd3eed0673 .

Here's one life's most important financial tips: always pay yourself first. Whether that means investing a set amount of salary into a 401k each paycheck or placing a set percentage of income into a savings account each month, this simple tip can make a huge difference in planning for a solid financial future. It changes the perspective from that of saving whatever is left to a consistent and sustainable method of building capital. Though it is important to take care of debts and expenses, you are also important. Our goal is help you see that money is not only a tool for survival but a way to enjoy life to the fullest. Accidents happen, it is just a fact of life. Though you cannot plan for these things to happen, you can prepare for them. This is where having a "rainy day" fund comes in. Built from the strategy of always paying yourself first, you have a safety cushion to help take these setbacks with stride. So when you are budgeting for this month or if you are going to budget for the first time, remember, pay yourself first!